Compliance has become one of the most critical aspects of business operations. From payroll laws to tax regulations and state-specific rules, every organization is expected to remain updated and error-free. However, manual processes often create room for mistakes, leading to penalties, legal risks, and operational inefficiencies. This is where technology steps in. A robust Human […]

Running payroll is more than just crediting salaries—it involves a complex network of statutory filings, tax deductions, and compliance responsibilities. Even a small error can result in penalties, employee dissatisfaction, or compliance risks. That’s where CloudServ steps in. We provide an end-to-end solution that integrates payroll processing with statutory compliance, ensuring accuracy, timeliness, and peace […]

Hiring and retaining a full-time HR resource may seem like the traditional way to manage payroll, compliance, and employee documentation — but is it still the smartest way? For growing businesses, especially in cost-sensitive sectors, a more efficient alternative is emerging: outsourcing HR operations to a specialized partner like CloudServ. 🔹 The Real Cost of […]

Why Payroll Compliance Requires More Than Just Calculations When it comes to payroll, accuracy isn’t just about numbers — it’s about law. Companies today often rely on payroll providers who are excellent at calculating salaries, generating payslips, and maybe even managing a few compliance checklists. But here’s the real question: Do they understand the law […]

Managing payroll today goes far beyond just calculating salaries. It’s about ensuring legal accuracy, staying updated with evolving tax laws, avoiding penalties, and maintaining employee trust — all while freeing up your internal HR bandwidth. That’s where CloudServ steps in. As payroll outsourcing becomes a strategic move for modern businesses, CloudServ is redefining what it […]

The Employees’ Provident Fund Organisation (EPFO) has come a long way in digitizing employee services. Among the biggest improvements is the simplified PF transfer process using UAN (Universal Account Number)—making the experience faster, more transparent, and hassle-free. At CloudServ, we help employees and employers navigate this online transfer system smoothly, ensuring every step is correctly […]

From statutory deductions to government filings, organisations today must follow strict timelines and rules set by Indian labour and tax authorities. Missing a step can mean penalties, audits, and a loss of employee trust. 🔍 What is Payroll Compliance? Payroll compliance ensures that employee salaries, deductions, and statutory benefits are processed in line with Indian […]

In today’s fast-evolving business environment, employee expectations go far beyond salary figures. They demand accuracy, timeliness, transparency, and trust — especially when it comes to their pay. One missed payslip or incorrect deduction can shake their confidence in the organisation. That’s where payroll outsourcing plays a pivotal role in improving employee satisfaction. 🔹 1. Accuracy […]

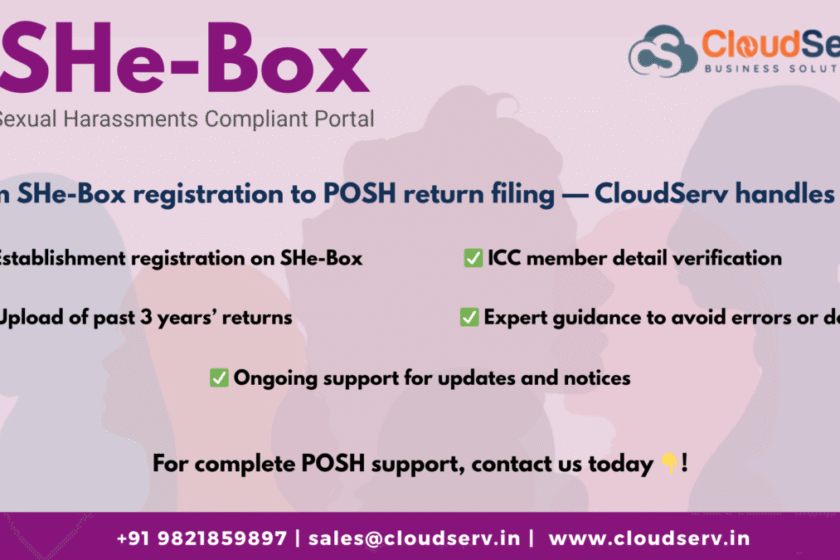

The Government of India has introduced a critical mandate to enhance women’s safety at workplaces. As per the press release dated 3rd May 2025, all establishments must now register under the POSH Act through the SHe-Box (Sexual Harassment Electronic Box) portal. This step modernizes and streamlines how organizations report compliance and handle internal complaints, marking […]

Union Budget 2025-26: Key Payroll & Compliance Highlights The Union Budget 2025 brings significant relief to salaried employees by restructuring income tax slabs. Individuals earning up to ₹12 lakh per annum are now effectively exempt from income tax under the new tax regime. These changes require payroll teams to update salary structures and tax deductions […]