PF and TDS may be central laws — but when it comes to statutory registers and labour filings, every state is different. CloudServ manages: 📌 State-specific Shops & Establishments Act requirements 📌 Labour Welfare Fund filings 📌 State registers (wages, attendance, fines, leave, bonus, etc.) 📌 Format-wise variations (hardcopy, digital, regional formats) Stay compliant — […]

The Employees’ Provident Fund Organisation (EPFO) has come a long way in digitizing employee services. Among the biggest improvements is the simplified PF transfer process using UAN (Universal Account Number)—making the experience faster, more transparent, and hassle-free. At CloudServ, we help employees and employers navigate this online transfer system smoothly, ensuring every step is correctly […]

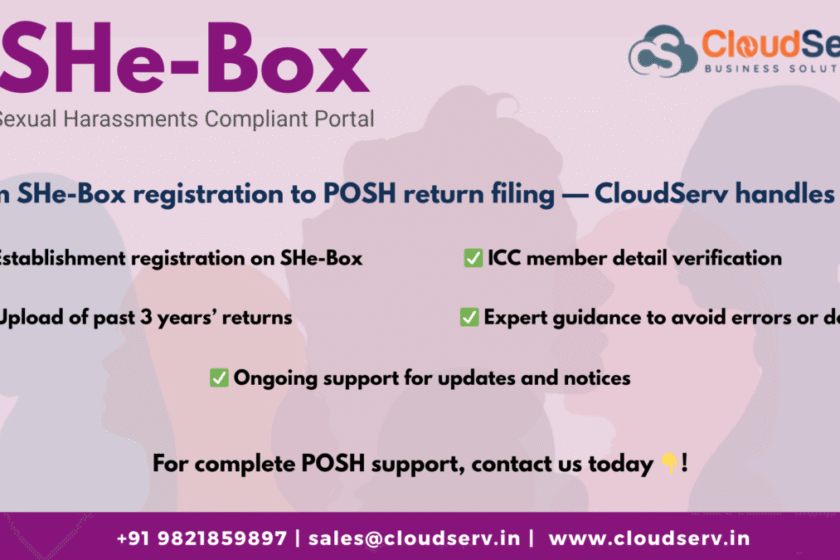

💡 CloudServ supports companies in becoming fully POSH compliant: ✔️ Policy drafting ✔️ IC committee setup ✔️ Awareness sessions ✔️ Annual report filing Let’s create respectful, law-compliant workplaces — together. 📞 +91 86910 55021 | 📧 sales@cloudserv.in 📢 Join WhatsApp Channel #POSHCompliance #SafeWorkplace #CloudServ #WorkplaceWellbeing #POSHPolicy #PreventionOfSexualHarassment

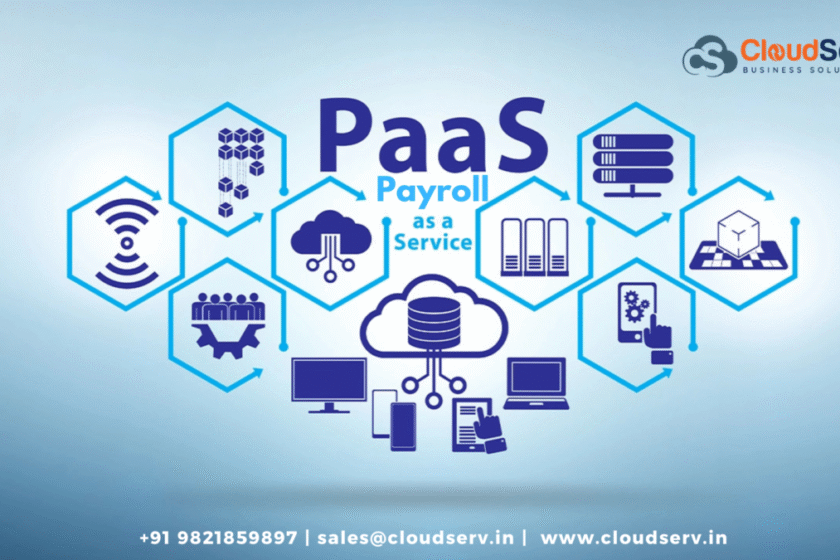

Is your HR team still spending days calculating payroll, deductions, and returns? With CloudServ, you can: ✔ Automate salary calculations ✔ Eliminate spreadsheet errors ✔ Save hours of HR bandwidth ✔ File PF, ESI, TDS on time — every time Payroll in minutes, not hours. That’s the CloudServ difference. 📞 +91 86910 55021 | 📧 […]

As your headcount increases, so do the complexities: 🔁 Multiple salary structures 🌐 Teams across locations 📄 Varying compliance rules 📤 Bulk salary processing 🧾 TDS, PF, and Form 16 for thousands That’s why you need a partner who grows with you. CloudServ manages payroll for companies with 5 to 20,000+ employees — without delays, […]

From statutory deductions to government filings, organisations today must follow strict timelines and rules set by Indian labour and tax authorities. Missing a step can mean penalties, audits, and a loss of employee trust. 🔍 What is Payroll Compliance? Payroll compliance ensures that employee salaries, deductions, and statutory benefits are processed in line with Indian […]

In today’s fast-evolving business environment, employee expectations go far beyond salary figures. They demand accuracy, timeliness, transparency, and trust — especially when it comes to their pay. One missed payslip or incorrect deduction can shake their confidence in the organisation. That’s where payroll outsourcing plays a pivotal role in improving employee satisfaction. 🔹 1. Accuracy […]

The Government of India has introduced a critical mandate to enhance women’s safety at workplaces. As per the press release dated 3rd May 2025, all establishments must now register under the POSH Act through the SHe-Box (Sexual Harassment Electronic Box) portal. This step modernizes and streamlines how organizations report compliance and handle internal complaints, marking […]

Union Budget 2025-26: Key Payroll & Compliance Highlights The Union Budget 2025 brings significant relief to salaried employees by restructuring income tax slabs. Individuals earning up to ₹12 lakh per annum are now effectively exempt from income tax under the new tax regime. These changes require payroll teams to update salary structures and tax deductions […]

What is Payroll-as-a-Service (PaaS)? Payroll-as-a-Service is a cloud-based solution that allows businesses to outsource their entire payroll management process to a trusted provider. This includes employee compensation, tax compliance, statutory filings, and record management. Unlike traditional payroll systems, PaaS provides businesses with: Real-time Processing: Faster and error-free payroll disbursement. Automated Compliance: Continuous updates on statutory […]